Financial technology, commonly known as fintech, represents innovative solutions that leverage technology to enhance and automate financial services. It includes a diverse range of applications, such as mobile banking, cryptocurrency, robo-advisors, and blockchain. Fintech is pivotal in increasing efficiency, accessibility, and security in financial transactions, transforming traditional banking methods.

Blockchain technology, often deemed revolutionary, is fundamentally changing transaction processes across various sectors. At its essence, blockchain is a decentralized digital ledger that securely and transparently records transactions across multiple computers. This technology ensures data integrity, transparency, and security through cryptographic principles.

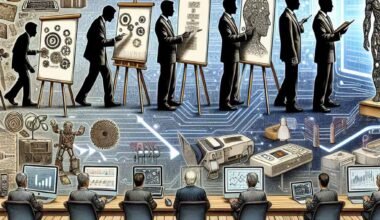

Studying Fintech Blockchain provides individuals with expertise in advanced technologies and insights into emerging financial trends. It equips professionals to navigate intricate regulatory environments and leverage disruptive innovations, ensuring they remain competitive in the market. A fintech course imparts practical knowledge in areas like artificial intelligence, data analytics, and blockchain. These are crucial for shaping the future of finance and driving innovation forward.

Blockchain Innovations: Transforming Fintech

Blockchain functions as a distributed ledger, enabling secure, transparent transactions without intermediaries. It allows participants to verify independently and audit transactions, fostering trust and eliminating the risks associated with centralized authorities.

Beyond cryptocurrencies like Bitcoin, blockchain finds applications in supply chain management, healthcare records, voting systems, and more. Smart contracts represent a significant advancement in finance. These self-executing contracts automate and enforce agreements, reducing reliance on intermediaries. They streamline processes in areas such as trade finance, supply chain management, and insurance.

Blockchain also enhances cross-border payments by improving transaction speed and security. Its decentralized nature reduces reliance on traditional banking systems, potentially lowering costs and increasing financial inclusion in underserved regions.

Cybersecurity Threats and Vulnerabilities in Fintech

Fintech companies encounter numerous threats and vulnerabilities, necessitating robust cybersecurity strategies. Common threats include phishing attacks, where cybercriminals masquerade as trustworthy entities to steal credentials. These attacks target both customers and employees, often resulting in significant data breaches.

Malware and ransomware attacks also pose considerable threats. Malware infiltrates financial systems, compromising sensitive data and operations. Ransomware locks down critical systems until a ransom is paid.

Vulnerabilities in fintech systems often arise from insecure application programming interfaces (APIs) that integrate various financial services. If not properly secured, APIs can be exploited, leading to data breaches and unauthorized transactions.

Outdated software and systems present another common vulnerability. They may have known exploits that cybercriminals can easily leverage. Thus, fintech companies must continuously update and secure their systems to mitigate these risks effectively.

Transformative Impact of Blockchain Across Various Sectors

The rapidly evolving dynamics of blockchain technology are swiftly reshaping multiple essential sectors. By introducing transparency, security, and efficiency, blockchain’s decentralized nature and immutable ledger offer a reliable solution for enhancing trust among stakeholders, optimizing operations, and paving the way for future innovations across various industries.

- Finance: Blockchain technology is revolutionizing the financial sector. Through smart contracts, it facilitate faster and cheaper cross-border payments. Additionally, blockchain’s decentralized ledger ensures transparency and security, providing both businesses and consumers with greater confidence in financial transactions.

- Supply Chain: In supply chain management, blockchain enhances transparency by enabling the traceability of goods from their origin to the end consumer. By recording every transaction and movement on an immutable ledger, blockchain ensures the authenticity of products and reduces the risk of fraud. This transparency improves trust among supply chain participants and helps identify and address issues such as counterfeiting and supply chain inefficiencies.

- Healthcare: Blockchain technology secures patient records and streamlines data sharing among healthcare providers. Blockchain also enhances interoperability between different healthcare systems, enabling seamless exchange of medical information while maintaining patient privacy and data integrity.

- Government: Governments are leveraging blockchain to increase transparency and efficiency in public sector operations. Blockchain-based voting systems enhance the security and integrity of elections by providing immutable records of votes.

- Real Estate: In real estate, blockchain enables faster and more secure property transactions through smart contracts. Blockchain’s transparent and auditable ledger simplifies title transfers and minimizes the risk of fraudulent property transactions.

- Legal: Blockchain automates contract execution and enforcement through self-executing smart contracts. These contracts are programmed to execute and enforce terms and conditions once predefined criteria are fulfilled, reducing the need for legal intermediaries and minimizing disputes. Blockchain technology ensures transparency and trust in contract agreements, making the legal process more efficient and cost-effective.

- Education: Blockchain ensures the integrity and security of educational credentials through blockchain-based certification systems. Blockchain technology enhances the credibility of academic achievements, reduces the risk of credential fraud, and facilitates lifelong learning and professional development.

- Insurance: In the insurance industry, blockchain streamlines claim processing and settlements through automated smart contracts. These contracts automatically trigger claim payments based on predefined conditions, reducing administrative costs and processing times. Blockchain’s transparency and immutability also improve fraud detection capabilities, ensuring greater trust between insurers and policyholders.

- Digital Identity: Blockchain provides secure and portable decentralized digital identity solutions on blockchain enable users to manage and verify their identity credentials securely across different platforms and services.

Conclusion

FinTech and blockchain are dynamic and complex fields. Protecting digital assets necessitates a multifaceted approach, including robust security measures, regulatory compliance, and continuous vigilance against emerging threats. By adopting Blockchain Management Courses and best practices and staying informed about technological advancements, companies can safeguard digital assets and maintain customer trust in an increasingly digital world.

In conclusion, blockchain technology’s evolution beyond Bitcoin encompasses smart contracts, DeFi, and cross-border payments. These innovations promise efficiency, accessibility, and security enhancements in fintech. However, achieving its full potential requires navigating diverse regulatory landscapes to ensure responsible innovation and widespread adoption in the financial sector. Fintech and blockchain technology are significantly transforming various sectors by enhancing transparency, security, and efficiency. Its adoption continues to grow, promising further innovations and improvements across numerous industries.